New Support For First Home Buyers In New South Wales

Some great news for first home buyers in New South Wales, there are two new schemes that make buying a home more affordable and accessible! The updated First Home Buyers Assistance Scheme and new First Home Buyer Grant now means that any permanent Australian resident looking to purchase their first home could save up to $30,000

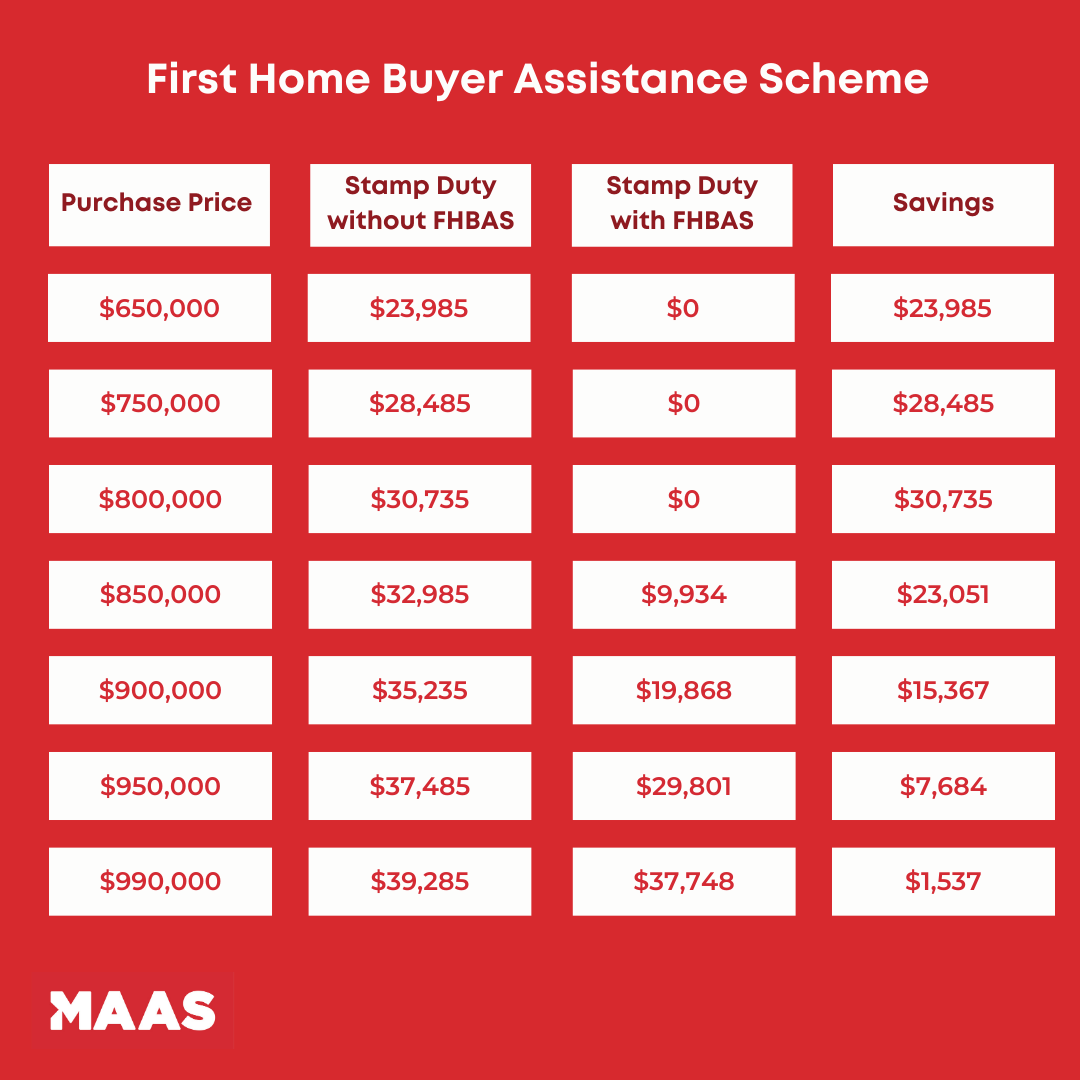

First Home Buyers Assistance Scheme

The First Home Buyers Assistance Scheme helps first home buyers in NSW by reducing or eliminating the transfer duty they need to pay when purchasing a property. The scheme has been updated to raise the thresholds for tax exemptions and concessions, making it easier for people to enter the property market.

Under the updated scheme, if you exchange contracts on or after July 1, 2023, you can get a full exemption from stamp duty, if you're buying a new or existing home worth up to $800,000. If the home is valued between $800,000 and $1 million, you'll pay a reduced tax rate. If you're buying vacant land to build a home, you may be exempt from stamp duty if the land is valued up to $350,000, or you'll pay a reduced rate if it's valued between $350,000 and $450,000.

To qualify for the First Home Buyers Assistance Scheme, you need to meet certain criteria, a breakdown of these criteria is available on the NSW government website.

First Home Owner (New Homes) Grant

First Home Owner (New Homes) Grant is only available to those who or building or renovating. This grant provides $10,000 in financial assistance and can be used for newly built houses, townhouses, apartments, units, or homes that have undergone substantial renovations.

To qualify for the grant, the purchase price of your new home must not exceed $600,000. If you're buying vacant land and signing a building contract with a builder, the total cost of the land, building contract, and any variations must not exceed $750,000. Unfortunately, the grant is not available for established homes.

*Information current as of July 5 2023 as provided by the NSW Government at www.revenue.nsw.gov.au/grants-schemes/first-home-buyer/assistance-scheme Please refer to the NSW Government for full eligibility and entitlements to meet your circumstances.

This article is for information purposes only. Maas makes no representations as to the accuracy or completeness of the information. Please be aware that it is always recommended to consult with relevant authorities and seek professional advice before applying the information contained in this article.